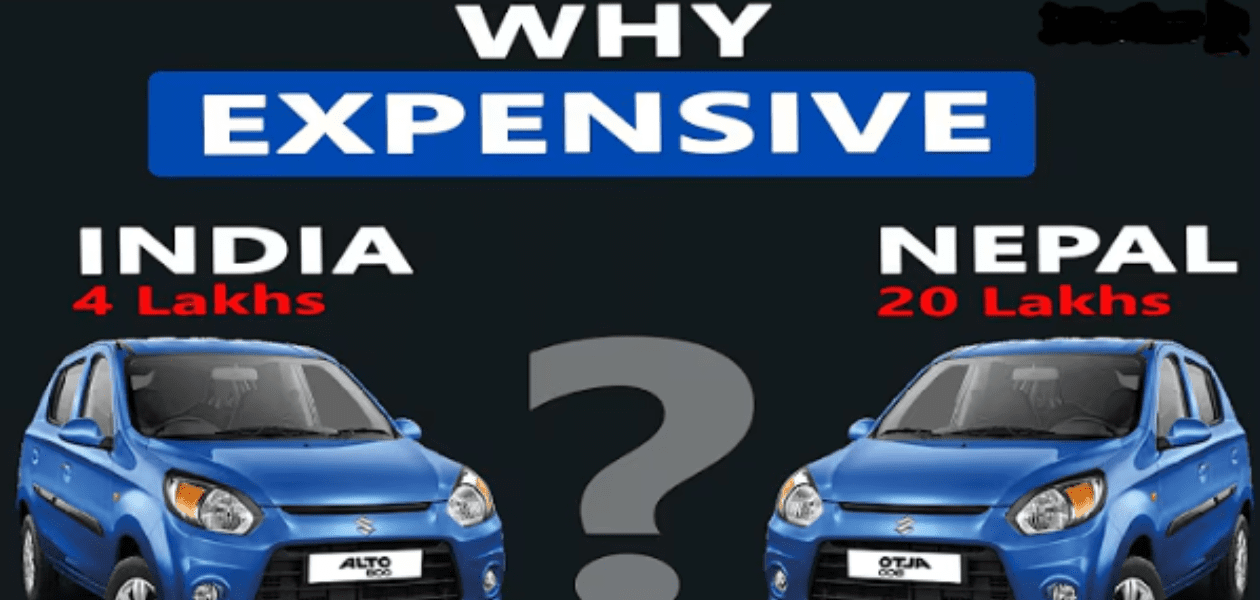

In Nepal, owning a car often feels like a luxury reserved for the wealthy. A vehicle that costs $20,000 in its home country can easily exceed $60,000 by the time it reaches Nepali roads. This steep price jump puzzles many, especially when incomes in Nepal remain modest. So, why are cars so expensive in Nepal? The answer lies in a mix of government policies, geography, and market dynamics. Below, we break down the key reasons behind these high costs, offering insights into what drives car prices in 2025.

1. Heavy Import Taxes and Duties

Nepal imports nearly all its vehicles, as it lacks a domestic car manufacturing industry. To regulate this and generate revenue, the government imposes substantial taxes. For petrol and diesel cars, customs duties, excise taxes, VAT, and road taxes can total up to 241-298% of the vehicle’s original cost. Electric vehicles (EVs) face slightly lower but still hefty taxes, often around 80-260%, depending on battery capacity and fiscal policies. For example, a Tata Nexon priced at Rs. 7.59 Lakhs in India can climb to Rs. 36.99 Lakhs in Nepal due to these levies.

2. Landlocked Geography and Logistics

Nepal’s landlocked location adds another layer of expense. Cars must be shipped to Indian ports like Kolkata, then transported overland across the border. This journey involves customs clearance, trucking costs, and delays, all of which inflate prices. Poor road infrastructure within Nepal further complicates delivery, increasing wear on transport vehicles and pushing up logistics fees passed onto buyers.

3. Limited Market Competition

With no local production, Nepal relies on a handful of international brands—mostly Indian (Tata, Maruti Suzuki), Korean (Hyundai, Kia), and Japanese (Toyota, Nissan). Limited competition means dealers face less pressure to lower prices. High demand for reliable brands, coupled with low supply, allows importers to maintain steep markups, especially on popular models like the Hyundai Creta or Toyota Fortuner.

4. Poor Road Conditions and Maintenance Costs

Nepal’s rugged terrain and underdeveloped road network—only recently connecting most districts—impact car pricing indirectly. Vehicles need higher ground clearance and durability to handle potholes, floods, and mountain paths. Importers prioritize sturdier models, which cost more to produce and ship. Plus, maintaining a car in Nepal is pricier due to scarce spare parts and skilled mechanics, adding to the ownership burden and justifying higher upfront costs.

5. Government Revenue Goals vs. Public Access

The government defends high taxes as essential for funding road expansion and maintenance, with Rs. 26 billion allocated in 2024 for nationwide infrastructure. Critics, like the Nepal Automobile Dealers Association (NADA), argue this makes cars unaffordable for the middle class, where the average monthly salary hovers around $300. A car costing Rs. 20 Lakhs requires years of savings or loans, yet tax reductions remain unlikely as vehicle duties are a key revenue stream.

Key Data Table: Car Cost Breakdown (Example)

| Factor | Tata Nexon (India) | Tata Nexon (Nepal) | Increase |

|---|---|---|---|

| Base Price | Rs. 7.59 Lakhs | Rs. 7.59 Lakhs | – |

| Customs Duty (241%) | – | Rs. 18.29 Lakhs | +241% |

| Logistics & Dealer Markup | – | Rs. 11.11 Lakhs | +146% |

| Total Price | Rs. 7.59 Lakhs | Rs. 36.99 Lakhs | +387% |

Note: Figures are illustrative based on 2024 trends; exact taxes vary by model and year.

Impact on Nepali Buyers

These factors create a stark reality: a car in Nepal can cost 2-3 times more than in India or the U.S. For instance, the Suzuki Alto, Rs. 3.39 Lakhs in India, jumps to Rs. 12.89 Lakhs in Nepal. This pricing pushes many toward cheaper, less safe options or public transport, despite growing demand—car sales rose 37% in 2023 despite the costs. Electric cars like the Dahe DH 350 (Rs. 13.90 Lakhs) offer some relief, but even they remain out of reach for most.

Conclusion

Cars in Nepal are expensive due to a combination of high import taxes, logistical challenges, limited competition, and the need for durable vehicles. While these costs fund infrastructure, they limit access for everyday Nepalis, making car ownership a distant dream for many in 2025. Understanding these reasons sheds light on the broader economic and geographic hurdles shaping Nepal’s automotive market.

Read More: Dahe DH 350: Nepal’s Most Affordable Electric Car in 2024